Just like regular health check-ups are crucial for kids, practice management reports are the lifeline of a thriving pediatric practice. Think of these reports as your practice's wellness checks, spotting potential hiccups before they become full-blown headaches.

But with so many options, which reports really matter? Here are three must-run reports that provide essential insights into your practice's financial health.

The Importance of Practice Management Reports

Practice management reports are your window into the inner workings and financial health of your pediatric practice. Rather than guessing where revenue might be slipping through the cracks, these data-driven reports pinpoint areas that need your attention.

Remember, no single report is a tell-all. Instead, they each provide a piece of the bigger picture. When combined, they offer a holistic view of your practice's operations, allowing you to make adjustments and optimize performance effectively.

Accounts Receivable (AR) Aging Report

The AR Aging Report organizes unpaid bills by age, displaying claims that are 30, 60, and 90 days overdue or more. It helps uncover collection issues like insurance plans that frequently pay late. By tracking these trends, you can predict potential cash flow shortfalls. To keep your collections healthy, run this report every month.

Appointment Utilization Report

The Appointment Utilization Report measures how well appointment slots are used by providers and the practice as a whole. It compares scheduled appointments with available slots to gauge scheduling efficiency. Low utilization indicates unused appointment times, which can affect revenue. Spotting gaps in provider schedules and certain days of the week can enhance scheduling. For optimal results, run this report weekly or monthly.

Patient No-Show Report

The Patient No-Show Report tracks missed appointments, which can impact both revenue and patient access. It counts the total number of missed visits and calculates no-show rates by patient and provider. If no-show rates are high, it might be time to enforce appointment reminders, introduce recapture protocols, and strengthen policies. Running this report monthly can help minimize missed visits.

How To Run and Use These Reports

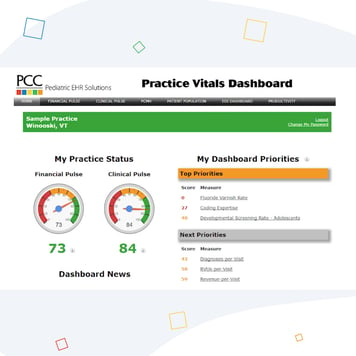

Running these reports is straightforward with the right tools. PCC's practice management software has built-in reporting and dashboards to easily generate these insights. Plus, our team can assist you in setting up custom reports that align with your objectives.

The key is to act on the data these reports offer. Regularly review these reports and swiftly address any issues to avoid revenue hiccups. With consistent monitoring and prompt action, your practice can function at its best!

Want More Revenue-Boosting Tips?

Grab our free guide, "5 Mistakes That Keep You From Running a Successful Practice," packed with additional insights from pediatric management expert Chip Hart.

Let us help you take your practice's financial health to the next level!